- Forests Over Trees

- Posts

- Arm IPO OMG

Arm IPO OMG

What is Arm?

Arm designs semiconductors. They’re part of the complicated supply chain of chip-making I wrote in The Game Worth $500B. Here’s a quick blurb for context:

Because it’s so complicated, most companies have prioritized a single step in the process. This helps them stay near the leading edge, and it makes collaborating with other firms absolutely critical. Here are the high-level steps and examples of firms at each step:

1/ Design: innovate new ways to lay-out chips and improve performance (Nvidia, Qualcomm)

2/ Build:

Equipment: create the machines used to manufacture chips (ASML)

Materials: create the chemicals and silicon wafers needed (Shin-Etsu Chemical Co)

Manufacturing: use materials and equipment to make chips (TSMC)

3/ Package & Test: put chips into encapsulated circuits and test them (ASE, Amkor)

Nvidia designs GPUs, the types of chips historically used to render graphics and recently re-cast as the one chip to rule them all (in AI). On the other hand, Arm focuses on microprocessors (CPUs), which run programs. Just like Nvidia, Arm dominates its niche, and they have chips in 99% of mobile phones globally. Part of the reason why is that they focus on being as efficient as possible, performing well enough while maximizing battery life. This makes them a great fit for the small spaces of a phone and other small internet of things (IoT) devices. But it’s not as great of a fit for AI, even though Arm does technically have some GPU products. AI is really energy intensive. You know the toggles that some computers and phones have, where you can choose between high performance or long battery life? Nvidia skews towards performance, and Arm skews towards battery life.

So who are Arm’s customers? Arm sells their designs to pretty much anyone, even direct competitors in a given market. Its customers include Apple, Samsung, Qualcomm, and AMD. And for the most part, Arm licenses entire designs, selling them “off-the-shelf”. However, Apple (as is tradition) is an exception. Apple has a special architecture license that allows them to customize the layout and sub-components of an Arm design, as long as the special Apple design can still run on Arm “instructions” (shorthand for the machine-level code that Arm chips run).

Why did Arm want to IPO?

Let’s start with a few relevant facts:

Softbank (who full owned Arm) announced a deal for Nvidia to acquire Arm in 2020 for $40B in cash and Nvidia stock. That deal fell through in Feb 2022 when many in the chips industry (Arm partners, customers, and competitors) lobbied against the deal, the FTC starting reviewing it, and Nvidia decided it wasn’t worth the hassle.

Softbank has had an extremely difficult time with their venture investments in the last few years. They lost big $$ on WeWork when founder Adam Neumann’s luck finally ran out. And they recently announced they had lost $6B in a single quarter (Q4 2022) and that they would be halting any new investments for a bit.

AI and chips are the new Bitcoin in the public zeitgeist. You can’t go a day without hearing someone talk about ChatGPT and the 13,524 ways it can help you, and people seem to know that chips are behind the AI.

Do you see where I’m going here?

In my opinion, the reason Arm is doing this IPO is that this is the perfect storm of opportunity and desperation. Softbank had taken Arm all the way to the finish line with the Nvidia acquisition, only to have it reversed at the last moment – creating a sense of loss. But beyond needing Arm to do well, Softbank needs a win to remind themselves that there’s an option other than just losing. Now that AI is the buzziest buzzword in buzztown, and people seem to actually know what the hell chips do, it is maybe the best time ever for a private chips company to go public.

So they got excited about an IPO, but they weren’t the only ones getting excited… Let’s talk about the other pro-IPO stakeholders.

Who else wanted this to happen?

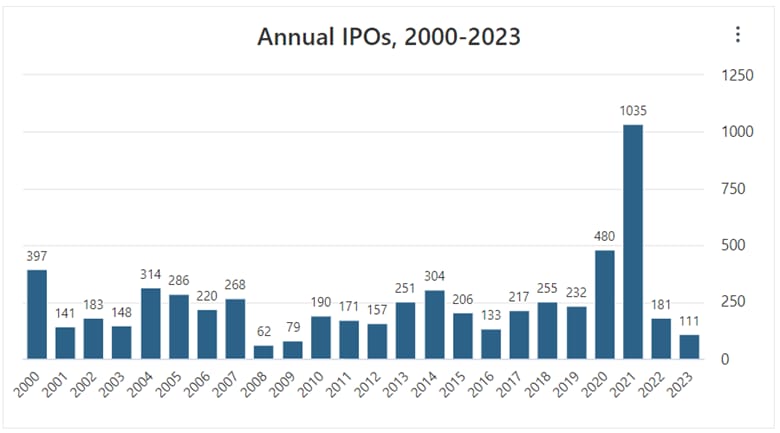

First, we have to mention the bankers. Being in the IPO business is good when IPOs are actually happening, because bankers get fees on the deal. But IPO’s haven’t been happening this year…

There are literally 28 banks helping Arm go public, being led by Goldman Sachs, and expected to generate $100M in fees. There was probably significant pressure from an this army of bankers to make this IPO a reality.

Second, and just as desperate…. other startups and startup investors. When you’re trying to convince highly talented, motivated worker bees to join a startup, you don’t have many levers. Larger tech firms can offer comp that’s 2-3x higher, with hours that are more stable, and offices that have 10x more kombucha. So startups don’t try to compete on that. Instead, they compete on equity, giving employees enormous upside if the company successfully exits with an IPO or with an acquisition by another company.

If you are trying to sell that dream while startups are dropping like flies and fundraising is weak (as I wrote about in VCs & Founders are Underdogs Again), and startups are dropping like flies… then that’s a bold strategy… good luck with that. If, on the other hand, you start to have companies going public (like Arm), and having a nice equity pop after going public (+25% for Arm on the first day of trading last week), that story is a little bit easier to sell. Same goes for startup investors who are putting up the cash needed to get these young companies from larva (startups) to full grown frogs (successful IPOs).

So are we back?

That’s the natural final question to ponder here. And honestly, I think the answer is no – we shouldn’t consider the IPO window fully back open or the Silicon Valley startup machine fully back up and running. When you see the pressure that this company is under to have a successful exit, and everyone else who is involved is also motivated to make it happen, then the IPO event itself isn’t enough for me to say “we’re so back, baby!”

And this is not investment advice, but Arm’s attempt to lean-in to the AI narrative (and hope that folks make the obvious comparison to Nvidia) doesn’t totally work for me. As we now know, their bread-and-butter are the CPUs, not the GPUs, and that CPU market feels more like a commodity than a specialized market with high upside.

So while I’m impressed that they went public – because it takes guts to do it in this environment, and they’ve pulled it off – that doesn’t mean we’re back. Yet.

Bonus Bullets

Quote of the Week:

Google's not a real company. It's a house of cards.

— Steve Ballmer, former Microsoft CEO, speaking in 2004

Quick News Reactions:

TikTok is tracking… it’s employees as part of a return-to-office campaign. They aren’t the only ones. Remote work is continuing to lose battles. TBD on the war.

Apple is hitting the road…with its new roadside assistance feature. It connects to AAA and uses GPS to find you, even when you don’t have cell service. Pretty awesome.

Google’s search antitrust case kicked off… a few weeks ago. In the proceedings so far, the DOJ has primarily focused on picking apart internal emails and trying to paint Google execs as fully aware of anti-competitive action. They even point to words being avoided and references to “legal training” as signs that people knew they might be watched. Spooky.

Tech Jobs Update:

Here are a few things I’m paying attention to this week:

Big Tech Job Posts: LinkedIn has 7,634 (-3.2% WoW) US-based jobs for a group of 20 large firms (the ones I typically write about — Google, Apple, Netflix, etc.).

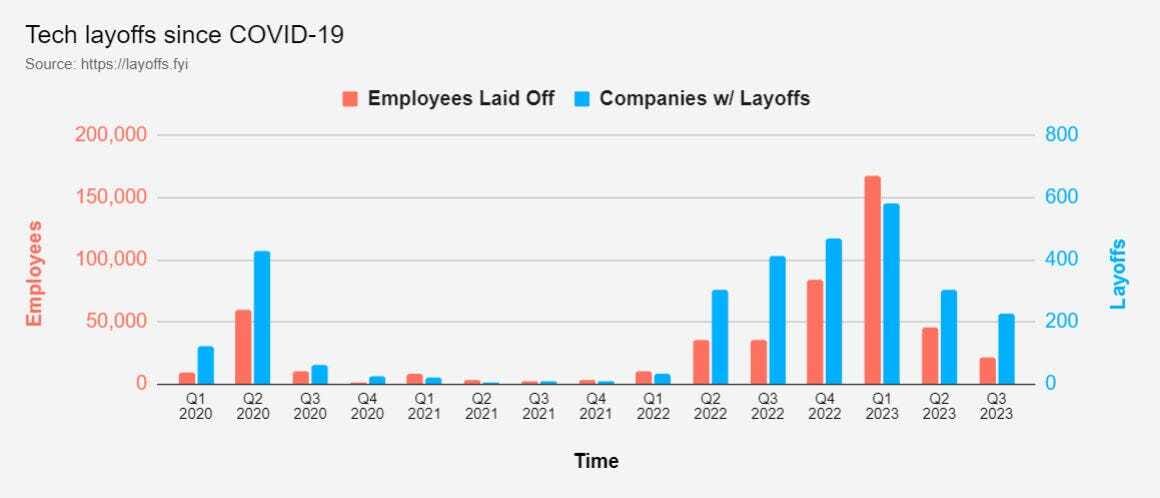

Graph: Layoffs since covid (Source: Layoffs.FYI)

Interesting Tech Jobs (see the full list at this new page):

Rewatch Senior Product Designer (Remote) – They automate meeting recording, transcribing, and searching. Never “grab notes” again.

Pindrop Business Development Representative (Atlanta, GA) – They do fraud detection to filter out spam calls. Love that for us.

Ribbon Health Data Engineer (New York, NY) – It’s a data platform for healthcare, so this position is close to the heart of the company, in a good way.

In case you missed it

Here are three other articles people have really enjoyed: