- Forests Over Trees

- Posts

- Belief is Contagious

Belief is Contagious

What Neumann and Masayoshi Have in Common

Adam Neumann – the infamous WeWork founder – is back in the news. But this time, rather than pitching us a rent-to-own residential real-estate business that is quite light on details (cough, “Flow”)… he’s getting back to his bread and butter. He’s pitching us that Flow should buy WeWork out of bankruptcy.

If that doesn’t (yet) strike you as ridiculous, let me plant some reminders here and check back in to see how you’re feeling:

Investors paid him $1.7B to leave the company less than 5 years ago. Why?

Because he chartered Gulfstream jets and partied on them. And?

He created a cult-like atmosphere that was more vision (and substances) than actual substance. And?

He trademarked “We” and made his own company pay for it ($5.9M). And?

HE LOST $14B FOR INVESTORS

Ok you get it – it’s wild.

Neu Beginnings

Based on reporting from the Wall Street Journal and others, it seems like he’s been trying to take back control for a while now, but WeWork’s exec team has stonewalled him… at least so far… something about tanking the company, losing a bunch of money, blah blah blah.

There’s no doubt that bankruptcy will be a cleansing process for WeWork (a chance to split off the non-performing properties and do a version of good bank / bad bank), so his timing isn’t the issue. It’s his belief. He believes so intensely and stubbornly in his vision for WeWork – or at least he appears to – that he bends reality to his will.

His belief is contagious

If you don’t believe me, you don’t have to look very far for examples, but the biggest of all is Masayoshi Son, the Japanese investor behind Softbank.

He reportedly experienced the contagion firsthand, when he agreed to invest billions in WeWork and Neumann after only 30 minutes with him.

But when I dug more into Masayoshi, I was surprised. The more I learned, the more I felt convinced that he wasn’t infected with Adam’s belief… or at least not only Adam’s belief… he had made a habit – a career – out of belief.

Belief as a strategy

The Evidence (mostly from a fantastic, old Verge article):

He got his start as part of the software boom, but not in the late 90’s like the other late adopters… he was there in the 80s, growing a software business that reached 50% market share at one point.

He took a bet on e-commerce in China, believing in a man named Jack (Ma) and Alibaba, and pocketing $60B along the way.

He bought Vodafone Japan, met and believed in a crazy vision from a man named Steve (Jobs), and locked in an exclusivity agreement to bring iPhones into Japan.

Sure, he picked the wrong team (aka not Starlink) to do satellite internet, losing $1B on OneWeb. But he was believing in the right product. And despite the huge, public loss he took on WeWork (~$14B according to Softbank’s public filings), Masayoshi seems to win more than he loses…

Speaking of which, did you hear about Arm?

Arm went public in September 2023, and on February 8th they announced that Q4 had beat expectations. The market went nuts, driving up Arm’s stock price by 57% at one point last Wednesday. And if you were to guess that maybe, because I’m including it in this post, this was somehow good news for Softbank and Masayoshi, you would be… correct. He owns 90% of the company, and the stock jump meant his investment popped by $34B in a single day.

As a cherry on top, and a final example of belief as a strategy, consider two rumored projects that Masayoshi has been plugged into. One is a project with Sam Altman to revolutionize semiconductor manufacturing, where Arm might play a pivotal role (talk about a win-win), and another is a visionary project with Sam Altman (yes, again) and Jony Ive to build AI devices for everyday people.

So what?

The meta point I wanted to make here – and thing that started to get under my skin when researching the background on Neumann and Masayoshi, was the blatant disregard for belief as a super-power. It’s not always good, but it can be.

Growing-up, we have better access to belief, from our career aspirations (fireman, duh, next question) to our holiday heros (Santa is real!). But it’s easier, when we grow older and ‘wiser’, to become cynical. It takes courage to counter that instinct, both when faced with slim odds, or when staring down the barrel at an unavoidable failure. So instead, catch some belief. It’s contagious. Like those kids from Angels in the Outfield said… “it could happen”.

Bonus Bullets

Quote of the Week

Culture is what happens when the CEO isn’t in the room.

— John Collison, Co-Founder of Stripe

Quick News Reactions

Waymo recall — Apparently, two of their vehicles got into fender benders with the same exact pickup truck… which is honestly funny (except if it’s your truck). Separately, can we just call them software patches? Recall feels very Model-T relative to what’s actually happening.

BTC > 50K — None of this is ever investment advice, but it’s fascinating to see investors getting excited about some risky assets. Call me crazy, but that market sentiment doesn’t seem to match the mood ‘on the ground’ (at least not when it comes to tech employment or VC investments, for example).

Zuck v Cook — Mark Zuckerberg has apparently threatened to fight Tim Cook just like he — kidding kidding… but he did fire shots at the Apple Vision Pro and say Meta’s headsets are better, which is not surprising. It sounds like they each have a few unique advantages, but of course CEO B thinks product B is better.

Overall Economy

This is the Weekly Economic Index published by the Dallas Fed. It’s made up of 10 different data sources from consumer to labor to production, and it’s designed to closely track US GDP.

Tech Equities & Bitcoin

The Nasdaq (blue) closely tracks tech equities, and I added the S&P 500 (green) and Bitcoin (orange) for comparison. Note: this is not investment advice, but it is interesting.

Tech Jobs Update

Here are a few things I’m paying attention to this week.

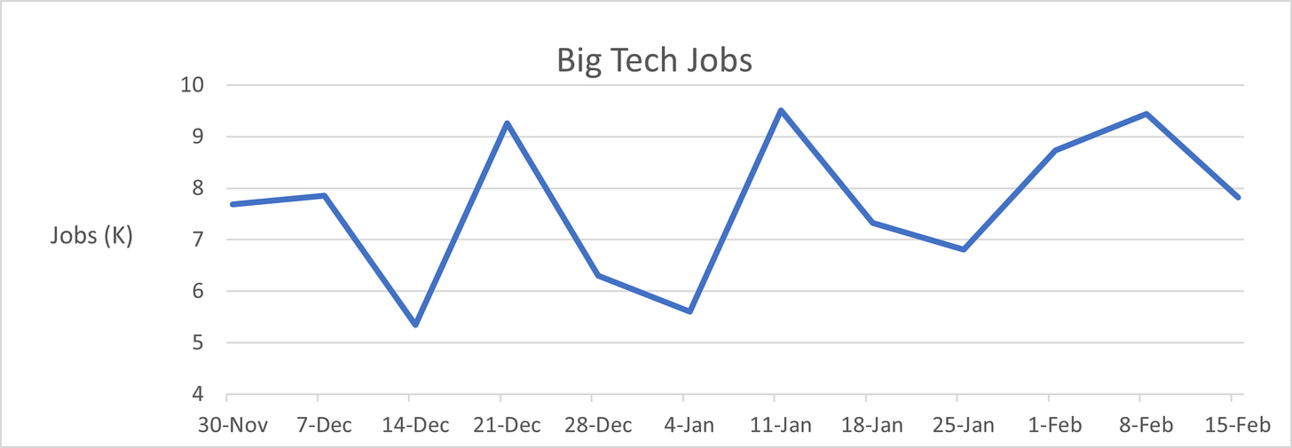

Big Tech Job Posts: LinkedIn has 7,823 (-0.2% WoW) US-based jobs for a group of 20 large firms (the ones I typically write about — Google, Apple, Netflix, etc.).

Layoffs from 2022-2024: (Source: Layoffs.FYI). Note that this is showing in-progress numbers for the current month.